The Injective ecosystem provides comprehensive DeFi infrastructure, from DEXs and liquid staking to lending protocols and yield optimization, enabling users to trade, stake, lend, and earn across the MultiVM environments. The following DeFi applications showcase the ecosystem’s ability to support sophisticated financial products, while maintaining the speed, modularity, and permissionless composability that defines Injective’s new standard in DeFi.

This guide will walk you through the Injective DeFi landscape and help you discover the cutting-edge DeFi applications within the ecosystem.

Trading on Injective

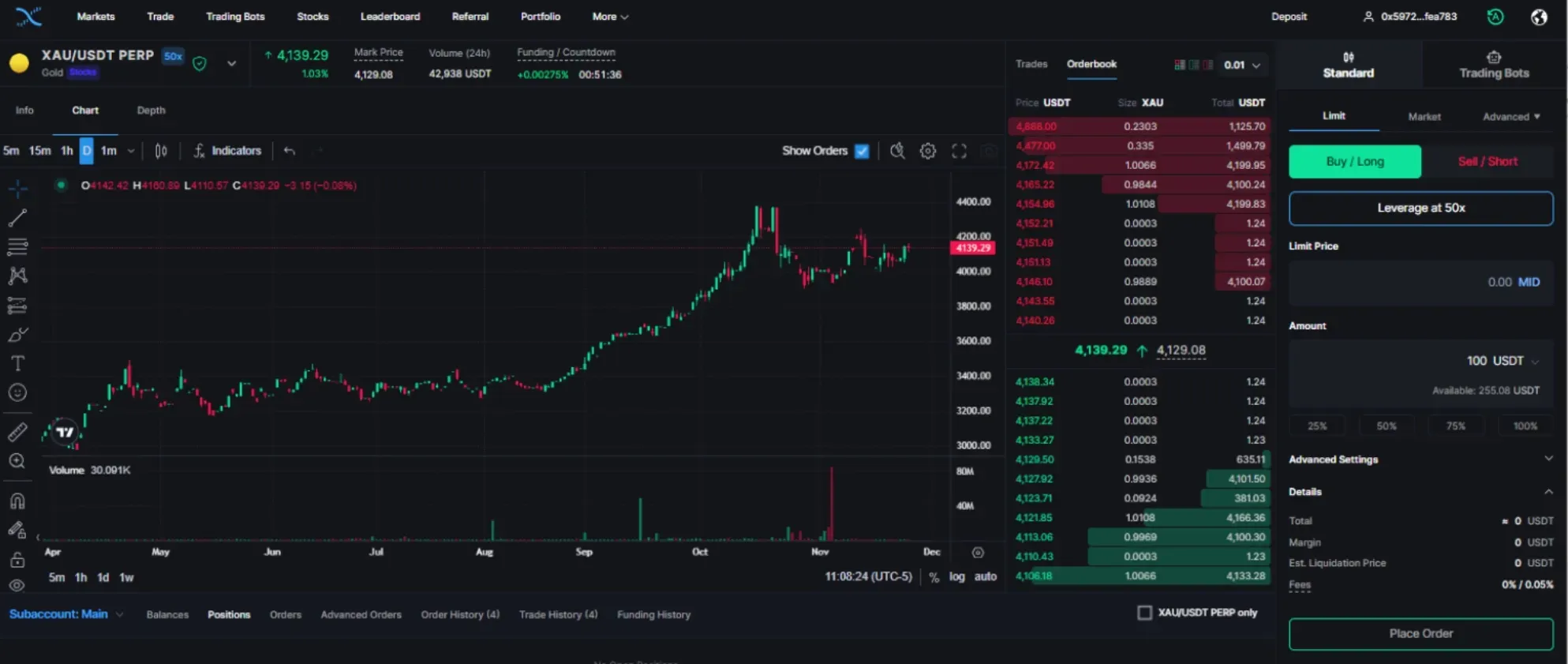

Helix

Helix is a decentralized exchange that offers spot trading, perpetual futures, and Real word assets (RWAs) such as real U.S. stocks, pre-IPO equities, gold, and other asset classes—fully onchain and permissionless.

At its core, Helix operates a fully onchain orderbook, giving users a trading environment that looks and feels like a centralized exchange, while preserving decentralization: transparent execution, permissionless access, and instant settlement. This makes Helix one of the first platforms where traders can interact with real equities and crypto assets inside the same interface.

Core offerings:

- Spot trading for majority crypto assets such as BTC, ETH, SOL, BNB

- Perpetual futures with deep liquidity and a familiar trading interface

- Onchain U.S. stock equities (NVDA, META, COIN, TSLA, etc.)

- Pre-IPO equity markets such as OpenAI, SpaceX and more private companies

- Gold and other RWA products, bridged directly into the onchain environment

- 24/5 real-time equity trading aligned with traditional market hours

All products share one unified account structure, letting users move seamlessly between crypto, perps, and equities without managing multiple apps or fragmented interfaces.

In short, Helix is the Everything DEX that brings crypto, perps, and real-world assets together in one place—offering a complete, modern trading experience directly onchain.

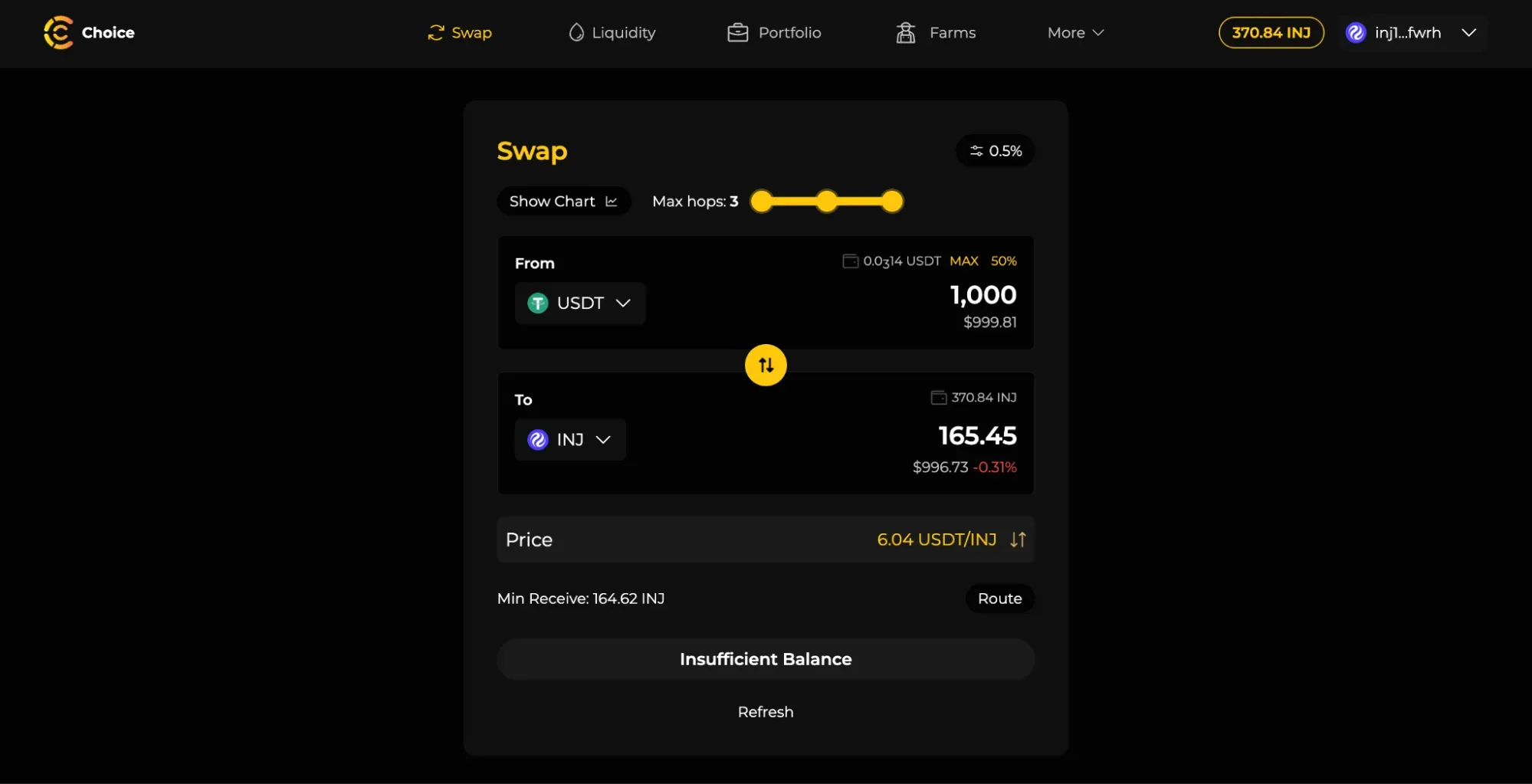

Choice

Choice is a decentralized exchange and aggregation layer designed to secure the most favorable swap execution. By tapping liquidity across all venues and employing a novel routing algorithm, users get an optimized multi-path route that reduces slippage on every trade.

Core offerings:

- Aggregated swaps sourcing from all spot venues

- CPMM liquidity provision for passive yield generation

- Liquidity farms to incentivize liquidity provision

- Auto-compounding vaults that maximize returns on farms

- Portfolio visualization which displays all token standards

By combining advanced routing, deep liquidity access, and yield-driven tools, Choice provides a powerful end-to-end environment for trading, earning, and managing your Injective portfolio.

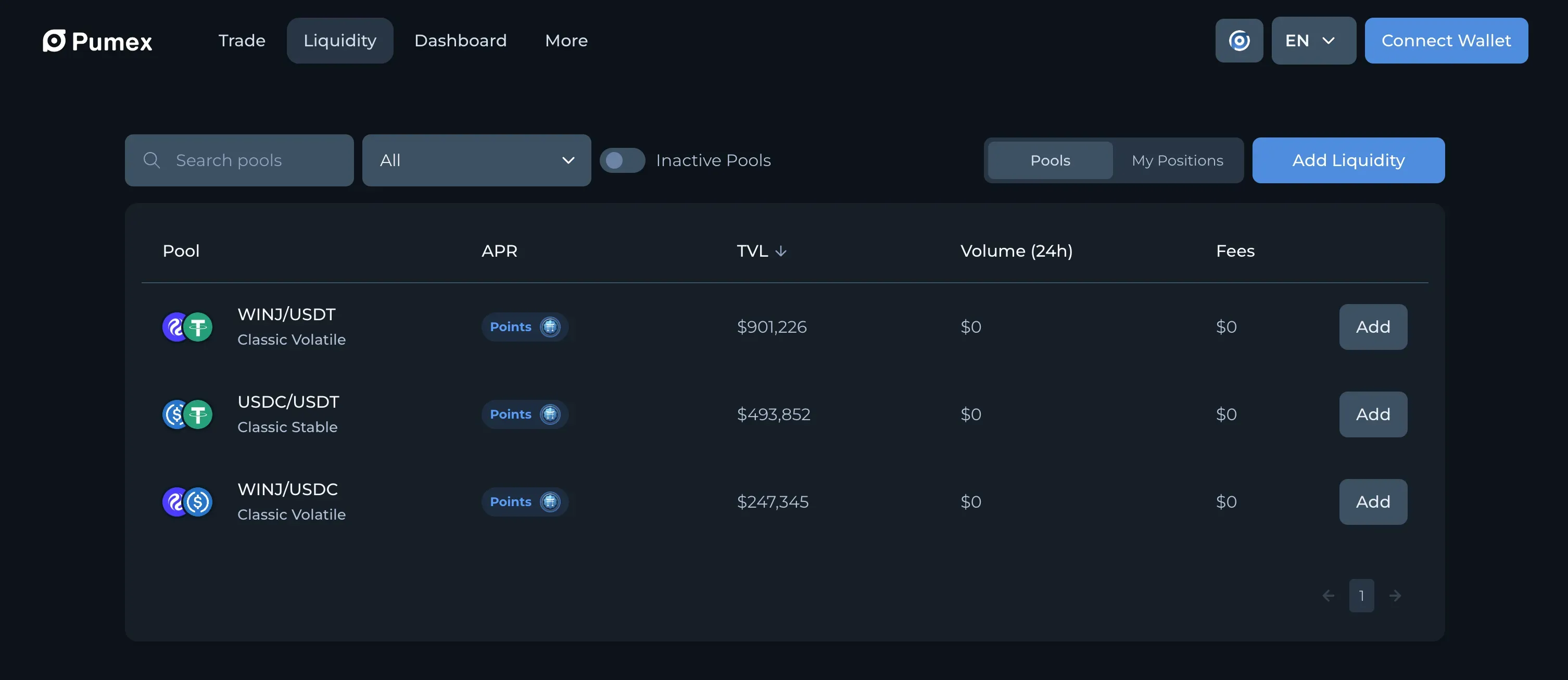

Pumex

Pumex is the next-gen MetaDEX on Injective. It aims to deepen liquidity, tighten pricing, and align incentives on Injective with a modular v4 engine, smart routing, and automated LP management. Built to be fast, flexible, and sustainable.

On Injective, Pumex benefits from real-time execution and zero gas fees, making it possible to rebalance strategies and optimize returns with precision.

Early markets are live on Pumex: www.pumex.fi/pools

Borderless

Borderless is the native DeFi hub on Injective that covers from pre-market to DeFi asset trading. Built to eliminate geographic and technological barriers, the platform allows permissionless trading across multiple blockchain networks. Its roadmap includes a focus on pre-token launch assets, offering new liquidity and discovery paths. By leveraging Injective’s native cross-chain capabilities and fast finality, Borderless ensures a seamless trading experience across ecosystems.

Core offerings:

- Trade with the curves you need: stable curves, custom curves

- Unlock DeFi features you like: hooks, dynamic fees

- Access any asset you want: native crypto assets, forex, tokenized stocks

Discover Borderless, the financial tools all in one: www.bswap.in

Liquid Staking on Injective

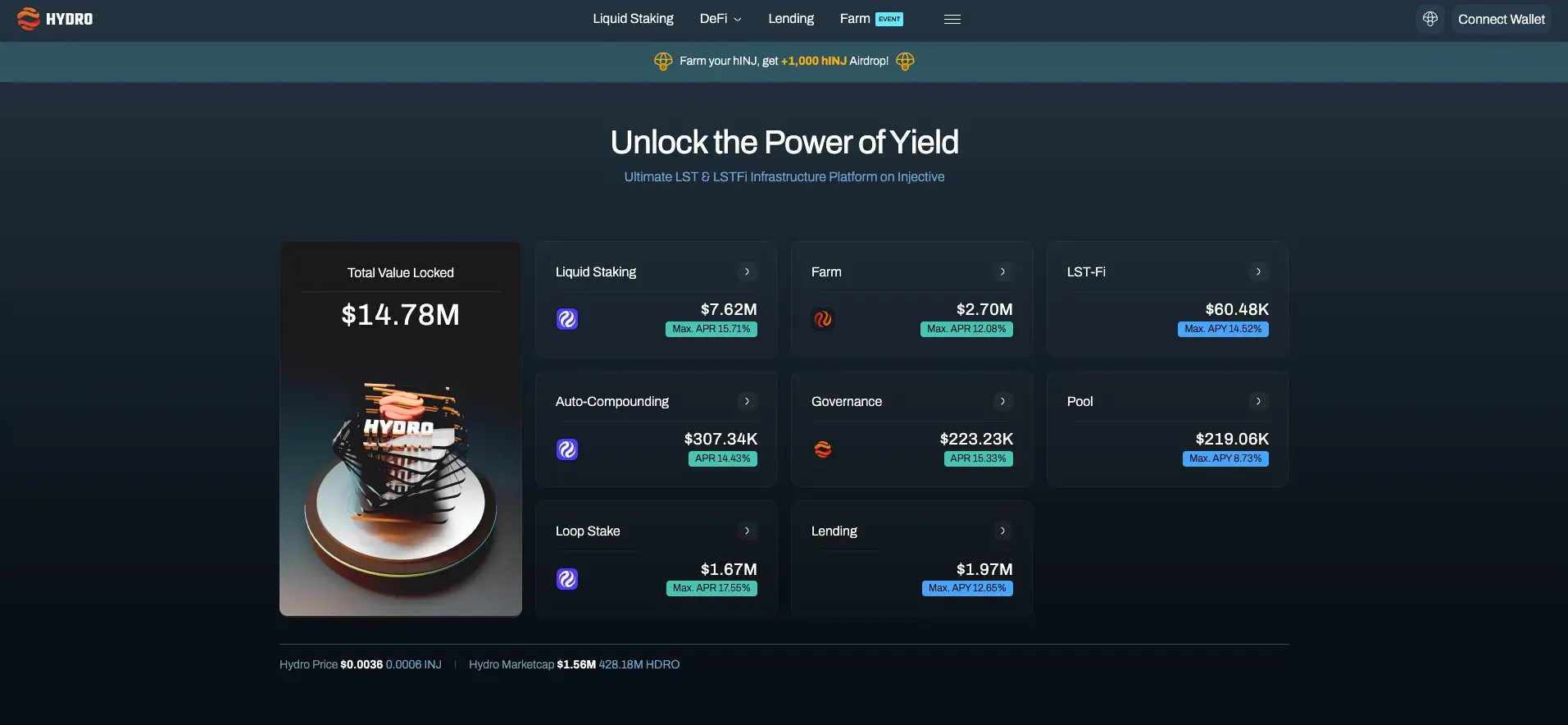

Hydro Protocol

Hydro is the ultimate Injective-native LST and all-in-one DeFi hub. It provides a unified LSTFi infrastructure that lets users maximize every DeFi strategy on the Injective Network. With Hydro’s LSTs, users stay fully staked while remaining liquid, enabling efficient utilization across trading, staking, lending, and farming.

Core Offerings:

- Liquid Staking: Stake INJ to instantly mint hINJ and yINJ, unlocking liquidity while maintaining staking rewards.

- hINJ: A 1:1 pegged liquid token that mirrors INJ and can be freely used across DeFi.

- yINJ: A yield-bearing LST that automatically accrues staking rewards over time.

- Users maintain staking yield while unlocking liquidity across the ecosystem.

- Farming: Hydro Farm offers high-efficiency reward strategies. Boost APR with xHDRO and maximize returns using your LSTs.

- Money Market: A secure, decentralized lending market where users can supply or borrow digital assets to optimize capital efficiency.

- Auto-Compound: Automatically reinvest staking rewards for seamless, gas-free compounding.

- Loop Staking: Hydro’s optimized leverage staking. Borrow against hINJ, restake, and amplify compounding yields safely and efficiently.

Hydro transforms INJ into a fully liquid, yield-optimized asset that works across every corner of the Injective ecosystem. A single protocol. Limitless strategies. Maximum efficiency.

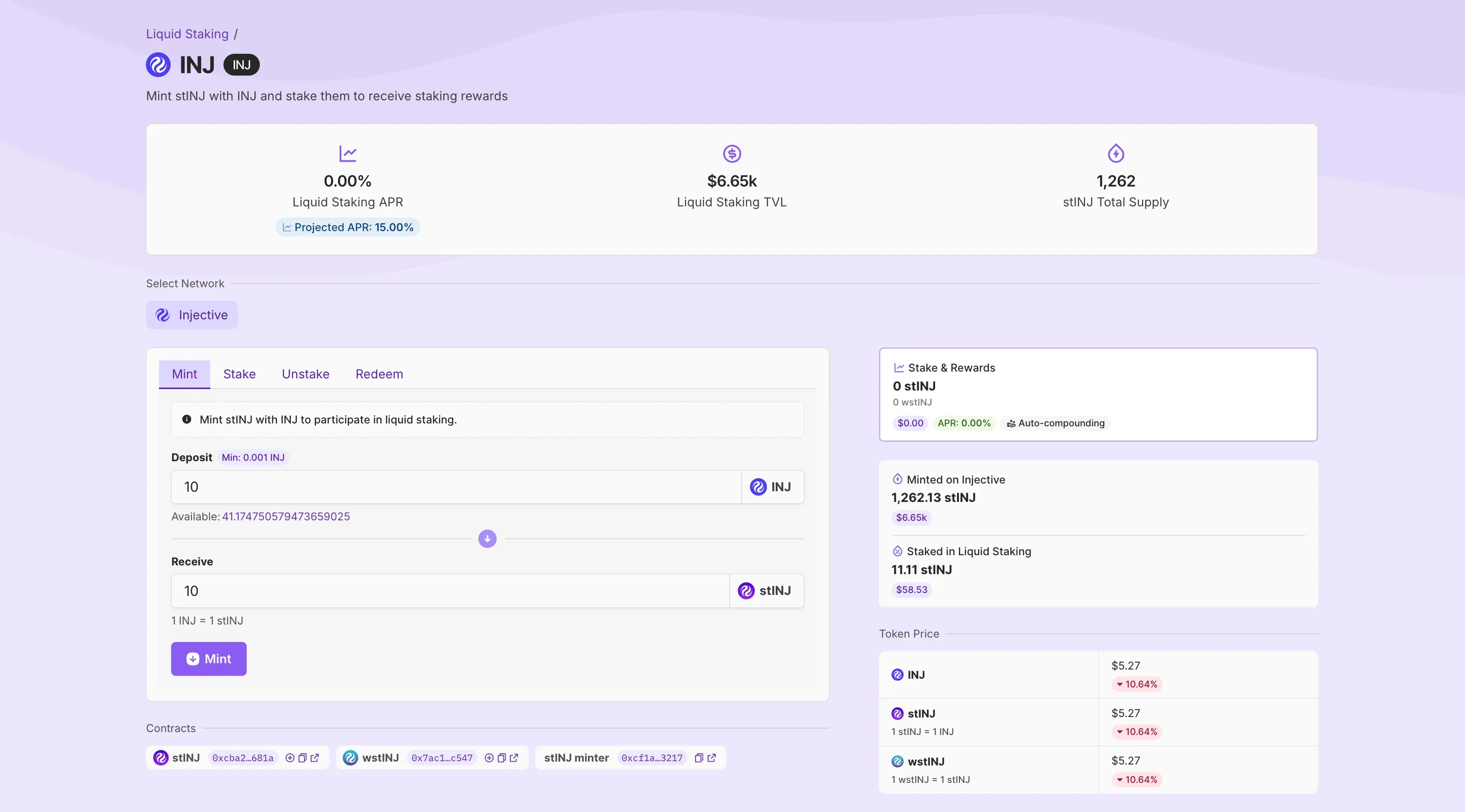

Accumulated Finance

Accumulated Finance is an omnichain modular liquid staking protocol that maximizes yield, liquidity, and utility of staked assets across multiple blockchain networks. It allows users to stake assets on supported Proof-of-Stake (PoS) chains, minting Liquid Staking Tokens (LSTs) for use in lending, borrowing, or leverage staking.

INJ liquid staking is now live on the Injective EVM. Users can mint stINJ with INJ to participate in liquid staking. Stake stINJ to start earning rewards. You will receive wstINJ that accumulates and automatically compounds stINJ staking rewards: accumulated.finance/stake/inj

Lending Protocols

Neptune Finance

Neptune Finance (nept.finance) is Injective's premier lending protocol for USDT, USDC, WETH, INJ, and more. Neptune serves everyone from passive yield seekers to advanced traders executing complex leveraged strategies. With cross-margin accounts, isolated subaccounts, yield-bearing collateral, and flash loans, Neptune provides the infrastructure for professionally engineered financial solutions.

Real-time alerts via Discord and Telegram track rate changes and health factors across all markets, while PID-controlled interest rates maintain tight spreads for consistently competitive borrowing that is ideal for vaults, credit strategies, and other DeFi integrations.

What Makes Neptune Different

- Better for Borrowers AND Lenders: PID-controlled interest rates automatically optimize to maintain tight spreads, delivering consistently competitive borrowing costs across major assets. This engineering-first approach creates efficiency for both lenders and borrowers, with proven performance across 230,000+ transactions.

- Advanced Position Management: Cross-margin accounts let you mix collateral types while isolated subaccounts separate risky strategies from safe ones. Neptune’s receipt tokens (aka nTokens) allow deposits to be used as interest bearing collateral within Neptune or within other applications.

- Developer-First Infrastructure: Neptune's nTokens and architecture integrate seamlessly across Injective's ecosystem. Earn lending yield while trading on Helix, use hINJ liquid staking as collateral, or take positions to Pryzm yield strategies. Developers tap into Neptune for access to flash loans, modular accounts, a simple API, and low-cost credit solutions.

Get started with as little as $1 to earn, borrow, and build with better rates. Visit: app.nept.finance

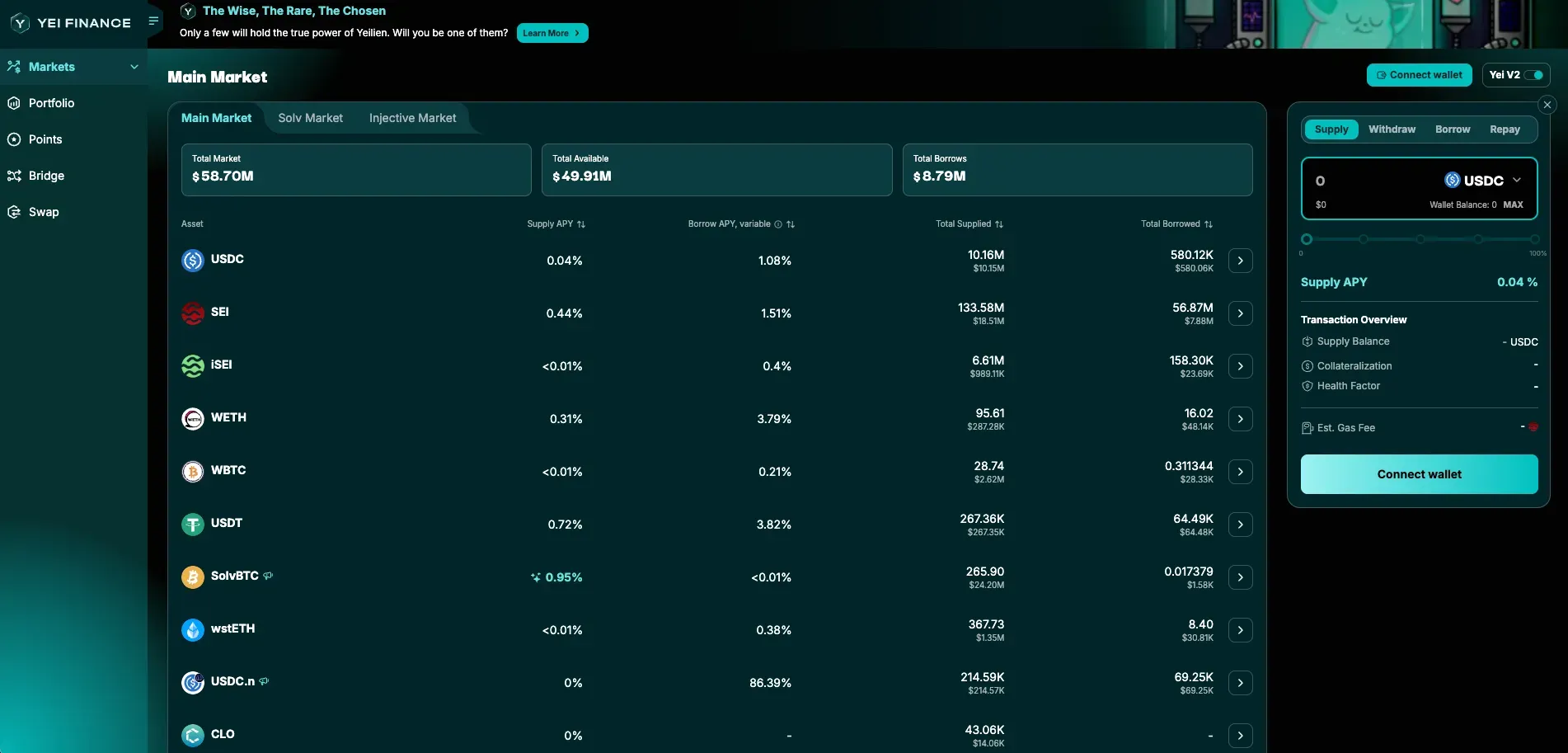

Yei Finance

Yei Finance was created to take the complexity out of cross-chain liquidity. Instead of juggling multiple pools, bridges, and different rates across chains, everything flows through a single clearing layer on Sei. Lending, swapping, and bridging all work together behind the scenes so users get a smoother, more consistent experience. Once assets enter Yei, they tap into shared liquidity, unified pricing, and fast settlement across the ecosystem.

Core Offerings:

- Lending and Borrowing (YeiLend): A global lending market that starts earning from the moment you deposit. Because Yei runs on a unified pool, rates stay aligned across chains, no more fragmented markets with uneven returns.

- Swap (YeiSwap): A DEX that mixes local AMMs with smart routing through the clearing layer. Swaps confirm quickly, and LPs earn both from trading fees and the underlying lending yield.

- Bridge (YeiBridge): Cross-chain transfers without the long waiting times. With local liquidity buffers and netting, most transfers settle almost instantly, making the bridge feel like a normal transaction.

Yei Finance pulls everything into one connected system so liquidity can finally move the way it should.

Faster transfers, better rates, and a unified cross-chain experience.

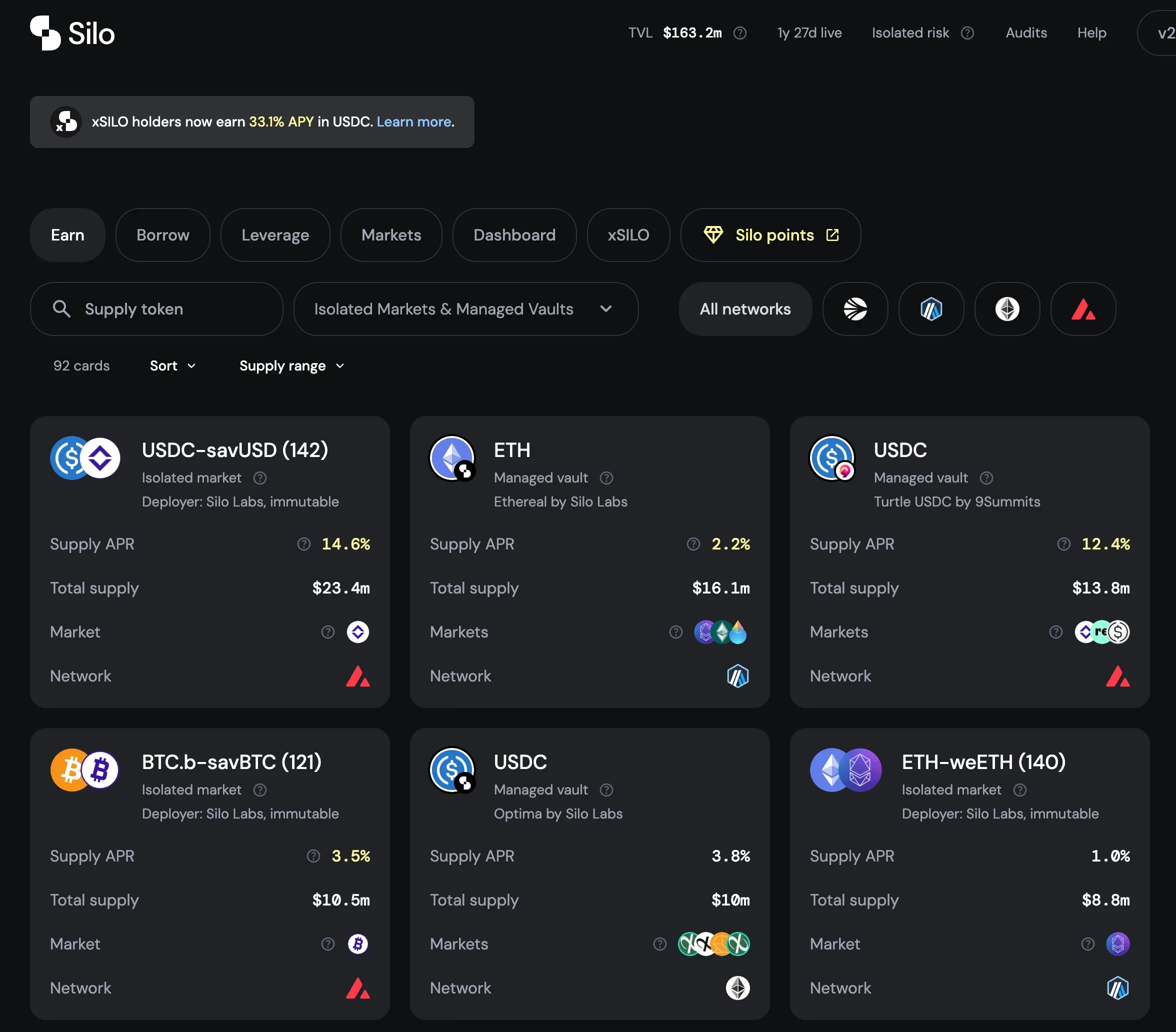

Silo Finance

Silo Finance is a non custodial, risk isolated lending protocol live on Injective’s MultiVM mainnet. Each market is a two asset silo, so lenders and borrowers only share exposure with a single pair instead of a shared pool. Every silo has its own oracle, interest rate curve and parameters, which keeps any stress local to that pair and makes risk easier to price for traders, vaults and structured products.

Core offerings:

- Risk isolated markets across pairs such as hINJ / INJ, INJ / USDT, INJ / WETH and WETH / USDT

- Supply side yields from borrower interest at the market level

- Single asset collateral borrowing with clear LTVs and liquidation logic

- Architecture that plugs cleanly into vaults, structured products and automated strategies

- xSILO staking that returns a share of lending revenue to long term participants in stablecoins

DeFi users turn to Silo to earn interest while keeping exposure limited to chosen pairs. Protocols and curators can route specific silos into their strategies knowing risk is constrained to those pairs, while xSILO holders receive protocol revenue distributions on top of any strategy yield.

In short, Silo Finance is the risk isolated lending layer on Injective for builders and users who want yields and leverage that match the exact risk they are willing to take.

Yield Products

RFY

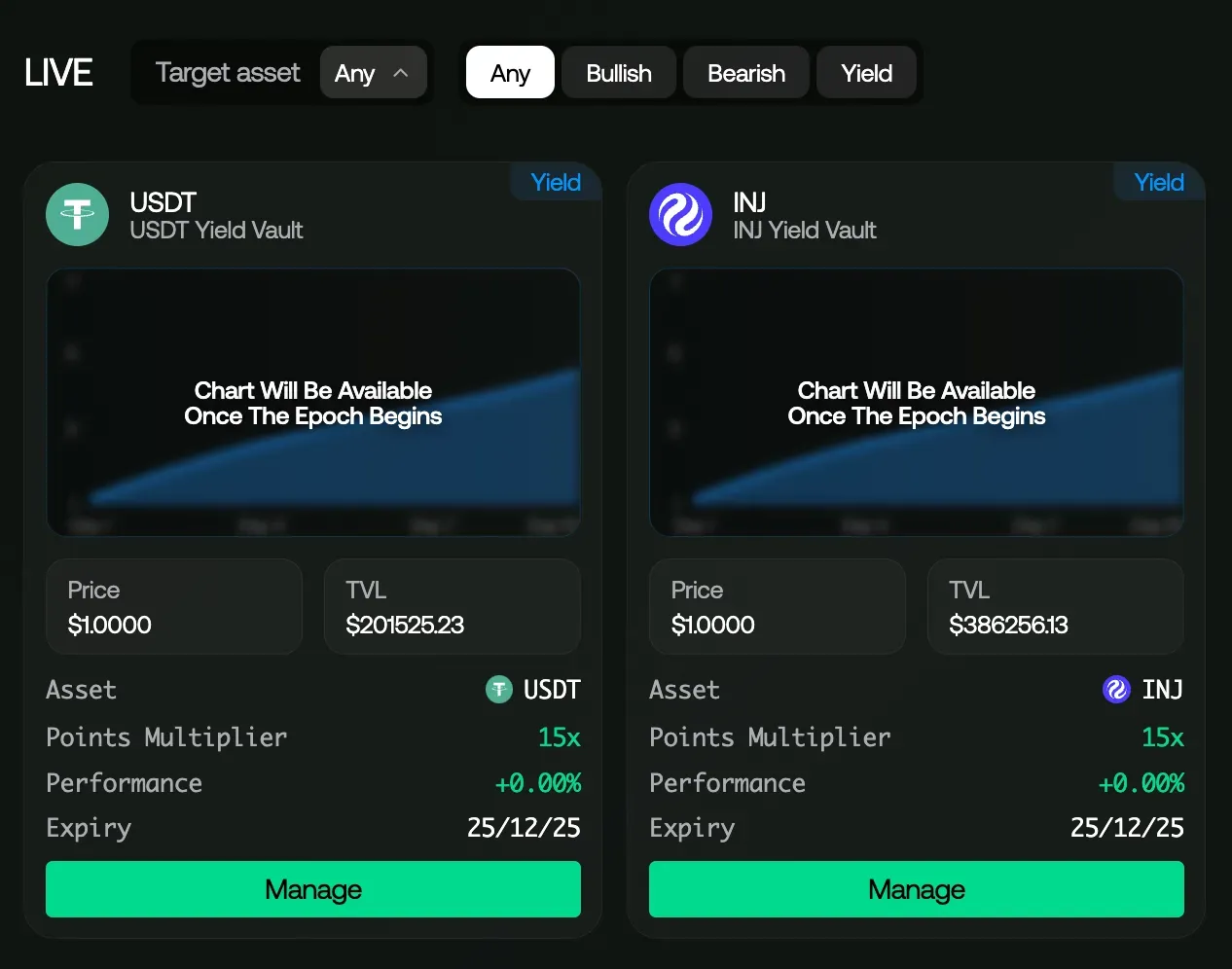

RFY is a yield protocol that bridges the gap between institutional execution and onchain composability. It enables users to earn returns from institutional-grade offchain option strategies executed by top market makers, while keeping assets fully onchain, transparent, and secure. Instruments that were only accessible to institutions now become accessible to all.

Core products include yield vaults (now live) and strategy vaults (launching soon). Each RFY vault operates in fixed-term epochs with three phases.

- A deposit period where users add supported assets (INJ, USDT, BTC, with ETH coming soon).

- A strategy period where assets are deployed both onchain for neutral yields and offchain for strategies like covered calls, basis spreads, or volatility harvesting.

- A redemption period where users can either withdraw their their receipt tokens for the underlying asset plus accrued yield or roll into the next epoch.

The pre-deposit campaign is now live. Explore the vaults and see how composable yield can work for you: rfy.finance. Meanwhile, be early and participate in the RFY Points Program. Earn RFY Points daily on your deposits: docs.rfy.finance/rewards/points

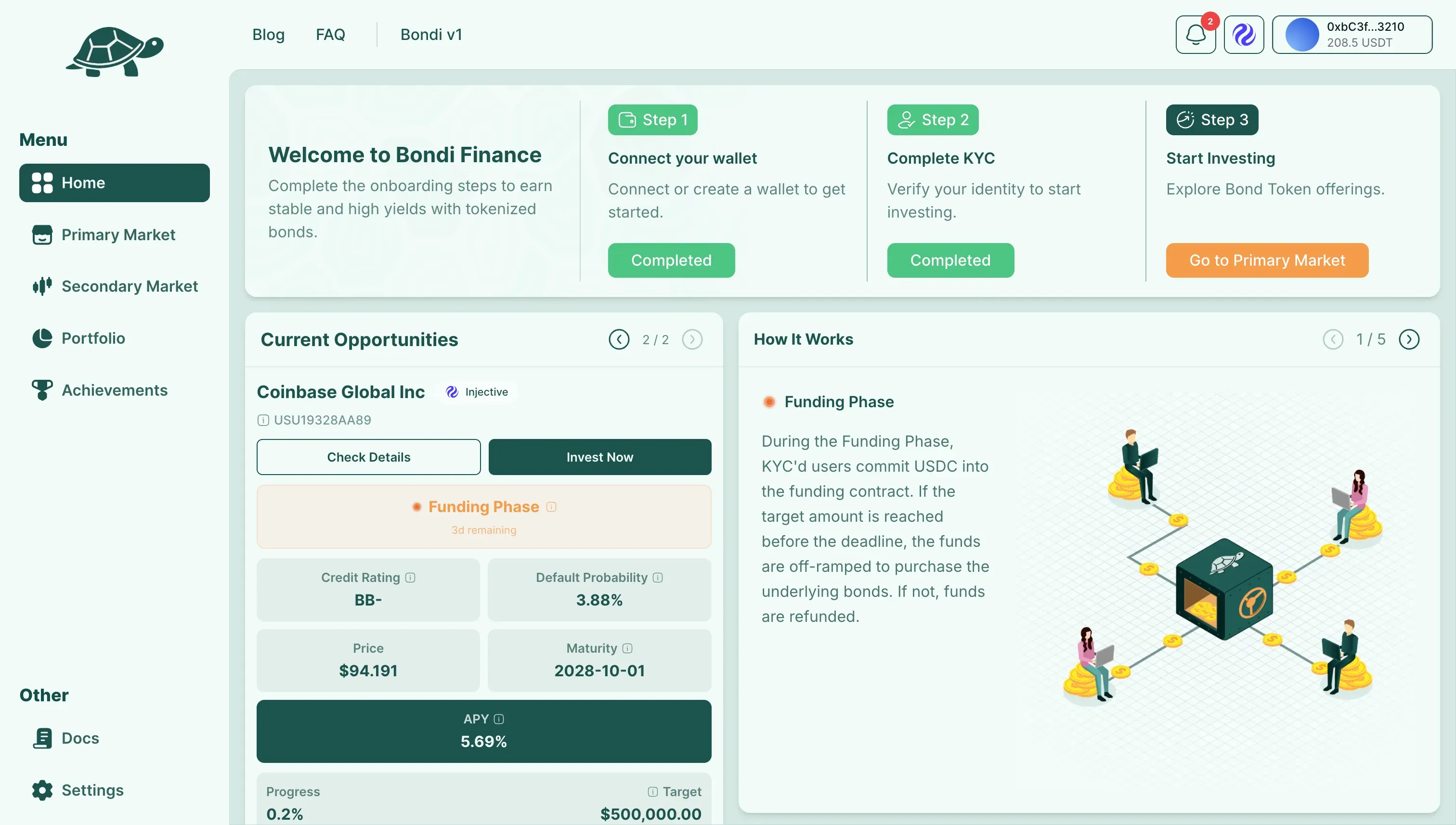

Bondi Finance

Bondi Finance brings publicly traded corporate bonds onchain. Bondi tokenizes real fixed income instruments and turns them into simple, composable onchain assets that integrate directly with the Injective ecosystem.

Bond Tokens are backed by underlying bonds held with licensed custodians. Coupons are paid automatically onchain and users get instant settlement with full transparency.

Core offerings:

- DeFi composable Bond Tokens representing publicly traded corporate bonds

- Automated onchain coupon payments

- Portfolio tracking with clear yield and maturity data

- Regulated, licensed custody of underlying bonds

- Secondary market interface for trading Bond Tokens

Users can buy, hold and earn from real corporate yields without brokers, regional limits or high minimum ticket sizes.

Bondi is the fixed income layer for Injective, giving users direct onchain access to real corporate credit.

This is just the beginning of the Injective MultiVM ecosystem. Beyond the above protocols, numerous additional DeFi applications are onboarding to Injective at mainnet across various categories. Visit multivm.injective.com to explore the ecosystem and join us in building the future of finance today!

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter